Aiming at satisfying domestic demand, China’s steel industry has grown up with and strongly supported the rapid development of the Chinese economy. From 2011 to 2015, an accumulated amount of 3.8 billion ton of steel was produced, satisfying the needs of 65% GDP growth and 128% fixed asset investment growth in China during the same time period. As China's economy shifting from high growth to medium-to-high growth and economic structure being optimized, China's steel industry will further give the market a decisive role in allocation of resources, steadily improve market order for fair competition, endeavor to reduce excess capacity, and continuously promote reform, innovation, transformation, upgrading, and green development.

I. Steel Production

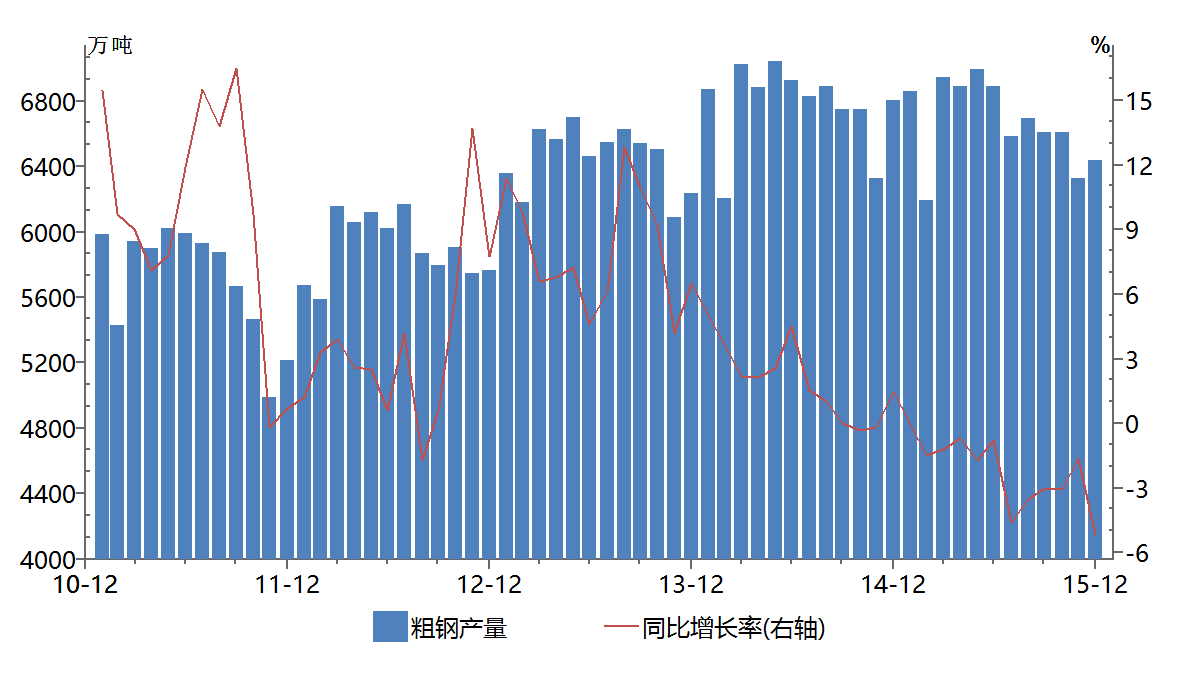

Crude steel production in China mainland was 804 million ton in 2015, 19.18 million ton lower than the year before, down 2.33%. In 2015, output of long products fell by 3.6%, pipe increased by 10.98% and flat rolled grew by 2.5% out of which cold-rolled sheet grew by 6.49%, and coated sheet increased by 2.67%. With crude steel production declined and the output of some high-end products increased, product mix of China's steel industry is optimized to some extent.

Crude Steel Production and Growth

The total production of crude steel in the world's 66 major steel-producing countries and regions was 1.6 billion ton in 2015, down 2.86% over the previous year. Crude steel production decreased in most of the major steel-producing countries and regions, and increased in a few countries as indicated in Table 1.

|

Crude Steel Production in Major Steel-producing Countries and Regions Unit: 10,000 ton, % | |||||||

|

No. |

Country (region) |

Production of Crude Steel |

Y-o-y |

No. |

Country (region) |

Production of Crude Steel |

Y-o-y |

|

1 |

China mainland |

80382.3 |

-2.3 |

6 |

South Korea |

6963.5 |

-2.7 |

|

2 |

Japan |

10536.4 |

-4.8 |

7 |

Germany |

4267.8 |

-0.6 |

|

3 |

India |

8978.8 |

2.9 |

8 |

Brazil |

3324.5 |

-1.9 |

|

4 |

U.S. |

7891.6 |

-10.5 |

9 |

Turkey |

3151.7 |

-7.4 |

|

5 |

Russia |

7111.4 |

-0.5 |

10 |

Ukraine |

2293.3 |

-15.6 |

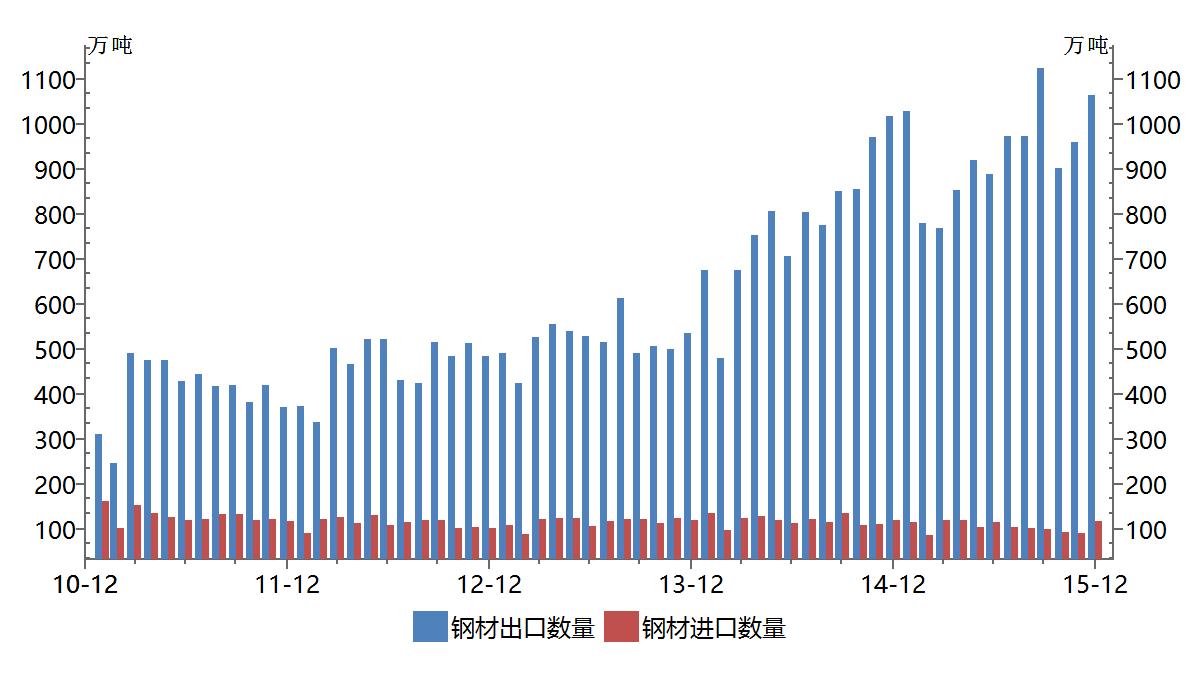

II. Steel Import and Export

China’s steel export reached 112 million ton in 2015, up 19.9% over the previous year, in which flat rolled and pipe products totaling 57.75 million ton, accounting for 51.38%; steel import stayed at 12.78 million ton, down 11.4% over the previous year; net steel export was equivalent to 103 million ton of crude steel, accounting for 12.81% of crude steel production of China.

Steel Import and Export

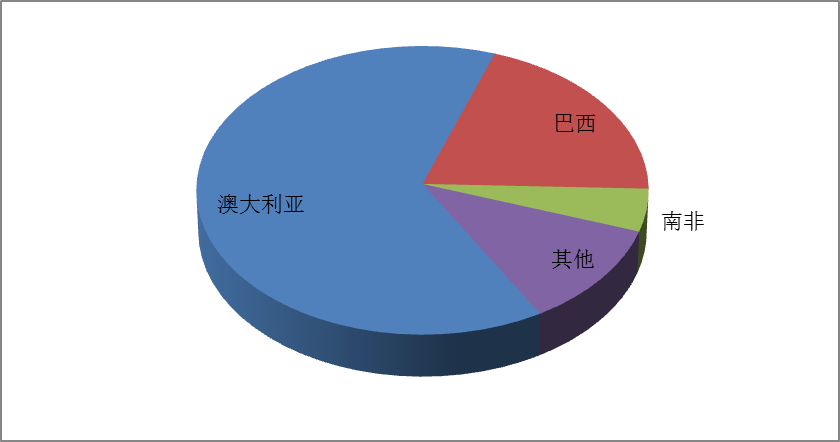

China imported 953 million ton of iron ore in 2015, up 2.2% over the previous year. Import from Australia was 607 million ton, up 10.76%; import from Brazil 192 million ton, up 12.1%; and import from South Africa 45.3783 million ton, up 4.06%. Iron ore import from Australia and Brazil accounted for 83.85% of the total import in 2015.

Sources of Iron Ore Imports

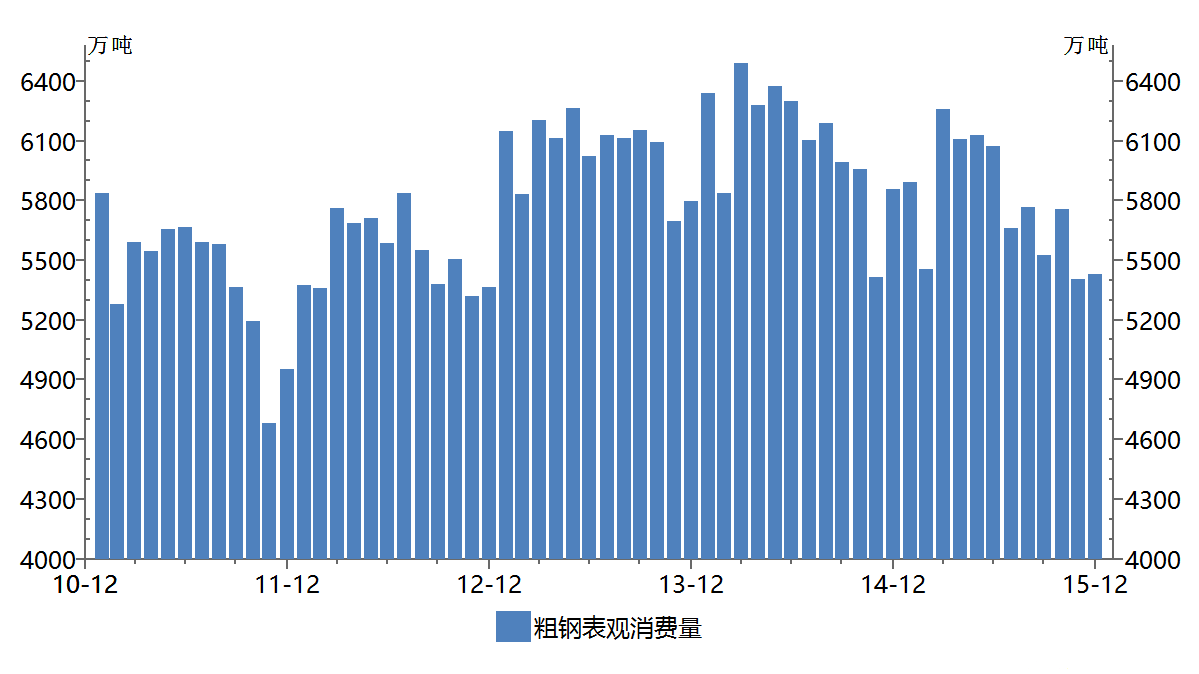

III. Steel Demand

Apparent crude steel consumption in China was 704 million ton in 2015, accounting for 43.2% of the world total, and China remains the world's largest steel market. Given the regional imbalance and characteristics of current stage in China's economic development, domestic market demand will stay stable at a fairly high level, and the outlook remains promising.

Apparent Crude Steel Consumption

IV. Economic Performance of the Sector

Steel prices slumped globally in 2015. The CRU international steel price index dropped 32.4% year on year at the end of December 2015, with the long products index dropped 28.5%, and flat products 34.6%. The CSPI China steel price index declined by 32.16%, with the long products index decreased 31.18%, and flat products 33.27%. The CRU international steel price index fell by a bigger margin than CSPI. Affected by falling steel prices, the performance of China's steel industry decreased. China's steel industry (including ferrous ore mining and the smelting and rolling processing industry of ferrous metals) generated a sales revenue of 7.2 trillion yuan in 2015, down 13.9% over the previous year, and a total profit of 97.19 billion yuan, down 60%.

V. Reduction of Excess Capacity

Steel excess capacity is a global issue. According to data from World Steel Association, the utilization rate of global crude steel capacity was 69.7% in 2015. China’s crude steel production capacity in 2014 was around 1.13 billion ton, and the capacity utilization rate was 71.2%, comparable to the global level.

The Chinese government, the steel industry and the steel enterprises have been proactively reducing excess capacity, and produced obvious results. In the 12th Five-Year plan period, more than 90 million ton backward steel capacity had been tided out; fixed asset investment for the steel industry had shrunk for two executive years with FAI for the ferrous metals smelting and rolling processing industry dropped 11% in 2015 compared with the previous year; market competition and environmental protection pressure had forced a batch of steel capacity out of the market including steel enterprises of all different ownerships.

In February 2016, the Chinese government issued “Guidance for the Steel Industry to Reduce Excess Capacity and Resolve Difficulties for Further Development”, planning to reduce another 100 to 150 million ton steel production capacity in the next five years with a series of specific measures. China will learn from the experience of developed countries in Europe and North America, endeavor to reduce excess capacity, taking care of displaced employees, and re-balance supply and demand as soon as possible.

VI. Technical Development

The steel industry, dedicated to serving economic development and satisfying the needs of downstream industries, has been constantly optimizing product mix and improving product quality. On one hand, overall quality of those steel products extensively used in construction, shipbuilding, automobile and other areas has improved and the proportion of steel for high-strength re-bars and steel structures rose with high-strength re-bar over 400 MPa taking a 70% to 80% share in pilot provinces and cities, and high-strength plate for shipbuilding exceeding 50%. On the other hand, an array of high-tech and high value-added products have been successfully developed, e.g. grain oriented silicon steel, steel sheet for magnet yokes and poles, and steel sheet for power station volute for large-scale hydro-power, thermal power and nuclear power stations is world leading in property; the three series of steels respectively for nuclear reactor containment, key nuclear island equipment and structural components for nuclear power station have been successfully applied in the world's first third-generation nuclear power project CAP1400; steel for high-speed rail bogie frame and steel for 350 km/h high-speed train wheels will soon be ready for trial; and the third generation high-strength automobile steel was first launched in China.

VII. Energy Conservation and Environmental Protection

In accordance with the requirement of green development, China’s steel industry has increased inputs in capital, talent, technological research and development, and carried out valuable explorations in the new generation of recyclable processes for steel production, green manufacturing, and environmental management, etc. A number of advanced enterprises in energy conservation and environmental protection have emerged with Hesteel Tangsteel, TISCO and Baosteel becoming excellent showcases for green development. For Chinese enterprises, environmental protection is not mere pollution treatment but clean production and green manufacturing on the basis of integration and optimization of energy conservation technologies and efficient use of resources over the whole process.

The implementation of the new Environmental Protection Law in 2015 has put forward higher requirements and more stringent standards on the steel industry. Through intensifying investments, promoting technological upgrading and popularizing new technologies, the steel industry has made remarkable progress in energy conservation and emission control. With unit comprehensive energy consumption and unit emission of major pollutants decreasing year by year, total energy consumption and emission of air pollutants for the steel industry has entered the decline stage. For major member enterprises of China Iron and Steel Association, the average energy consumption per ton of steel decreased from 605 kg of standard coal to 572 kg from 2010 to 2015, exceeding the target of 580 kg in energy conservation ahead of schedule; new water consumption decreased from 4.1 cubic meters to 3.25 cubic meters, attaining the water-saving target of 4 cubic meters ahead of schedule; sulfur dioxide emissions decreased from 1.63 kg to 0.74 kg, surpassing the target of 1.0 kg; and COD per ton of steel decreased from 70g to 22g, realizing the target ahead of schedule.

VIII. Ownership Structure of Steel Enterprises

State-owned and private enterprises are both important parts of China's market-oriented economic system, and both are important forces to promote economic development. In recent years, China's rapid economic development has helped state-owned and private enterprises to enjoy mutual promotion and coordinated development. This is reflected more prominently in the steel industry. Private steel enterprises accounted for only 5% crude steel production in 2003 and today, the private sector enjoys absolute advantage in terms of number of enterprises, contributing more than one half of crude steel production. A number of 10 million ton size private steel producers have emerged, such as Shasteel, Jianlong Group, Rizhao Steel, Hebei Jingye Group, and Fangda Steel, etc.

In 2014, crude steel production capacity in China was 1.13 billion ton, in which state-owned enterprises accounted for 44.28%, and private enterprises 55.72%; crude steel production was 823 million ton, in which state-owned enterprises accounted for 49.64%, and private enterprises 50.36%. With the development of asset securitization, 34 steel enterprises in China have been listed and become share-holding public companies. At group level, these 34 enterprises have a total crude steel production of 391 million ton in 2015, accounting for 48.69% of the total for China.

IX. Steel Trade Policy

China does not encourage large volume steel export and has adopted a series of measures on the contrary to curb steel export, e.g. levying export duty to some steel products and voluntarily lowering tax rebate rates for steel products. China’s steel export has increased in recent years mainly due to demand rise in the international market with the recovery of the global economy, and competitiveness improvement of the Chinese steel products.

In recent years, steel trade frictions have increased. The Chinese government and the steel industry have attached great importance to this situation, go actively for self-discipline, regulate export order, and in the mean time, monitor exports to key regions, and actively strengthen communications with concerned governments, associations and enterprises, so to maintain stability in regional markets. The Chinese steel industry is willing to resolve trade frictions in a cooperative and win-win way, and join hands with international peers to maintain the normal international steel trade order, resolutely fight with trade protectionism, and oppose to politicizing the issue of steel trade.

X. International Exchanges and Cooperation

China’s steel industry is part of the world steel industry. The development of the Chinese steel industry is attributed to the rapid growth of the Chinese market, and also to the support and help from international peers. Under the new circumstances, China’s steel industry will open up further to the outside, strengthen the exchange with international organizations, and expand cooperation with international counterparts, raw material and fuel suppliers, and metallurgical technology and equipment providers. At the same time, we sincerely welcome international steel enterprises and investors with advanced technology and management experience to actively participate in the restructuring, transformation and upgrading of the Chinese steel industry.

China Iron and Steel Association has signed 16 bilateral exchange agreements and memorandums of understanding with 13 national and regional steel industry associations, regularly organize steel dialogue with ASEAN, EU, US, Japan, Korea and India, energy conservation and environmental protection exchange with Japan, statistical exchange with Japan and Korea, and workshops for senior steel mill managers e.g. for ASEAN and Euro-Asia countries.

China Iron and Steel Association participates actively in activities of World Steel Association and OECD Steel Committee; attends international conferences organized by ASEAN Iron and Steel Association, Korea Iron and Steel Association, Brazilian Steel Institute, Bureau of International Recycling and industrial consulting firms; brings Chinese enterprises to participate in industrial exhibitions in Germany, US, India, Russia, Brazil and Egypt, etc.

China Iron and steel Association hosts a number of international conferences and exhibitions including China International Steel Congress, China International Steel & Raw Materials Conference, International Steel Market and Trade Conference, China International Coking Technology and Coke Market Congress, China International Metal Recycling Conference, China International Refractory Production and Application Conference, China International Stainless Steel Congress, China International Metallurgical Industry Exhibition, China International Tube Exhibition and China International Stainless Steel Exhibition, etc.